No matter how securely you think you docked your boat, it can still end up damaging someone else's. So what happens if your boat bumps into another one while docked at a Tennessee marina? Who's responsible for covering the damage?

A Tennessee independent insurance agent can help you get set up with all the boat insurance you need to protect against this incident and many others, long before it's ever time to file a claim. But first, here's a breakdown of who's responsible in this unique scenario.

Who’s Responsible If My Boat Damages Another at a Marina in Tennessee?

The person who'd be held responsible if your boat bumped another at a marina would really depend on why the boats collided in the first place. You'd only be held responsible for covering damage to the other boat if it could be proven that the incident was due to your negligence. If you didn't properly secure your boat or didn't maintain it well enough and for some reason it caught fire, you could be held responsible for damage to other boats.

Will My Boat Insurance Cover the Damage to My Own Boat, Too?

Your Tennessee personal watercraft insurance should cover physical damage to your boat in this scenario. It's important to review your policy with your Tennessee independent insurance agent, however. Sometimes physical damage coverage for your watercraft is an add-on to boat insurance instead of being automatically included.

Is Boat Insurance Mandatory in Tennessee?

Tennessee does not require boat owners to have watercraft insurance by state law. However, it's critical to still get coverage for your watercraft just in case of marina incidents, or incidents on the water. Here are some stats about boating accidents across the US to prove it.

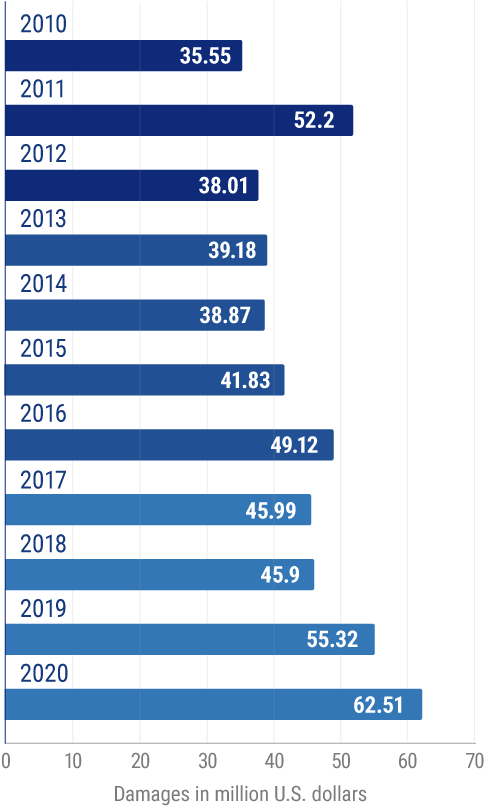

Total damage caused by recreational boating accidents in the US

The total damage caused by recreational boating accidents nationwide is increasing over time. In one recent year, a whopping $62.51 million in damage was caused by recreational boating accidents alone. That's quite an increase from the $55.32 million in damage reported the previous year, and way up from the $35.55 million at the beginning of the last decade.

Since damage from recreational boating accidents is becoming much more expensive over time, it's more important than ever to make sure that your vessel is protected by the right boat insurance. A Tennessee independent insurance agent can further explain the importance of having your own personal watercraft policy, beyond accidents.

What If You Don’t Own the Boat?

You can still be covered for this incident even if you don't own the boat that collided with another at the marina. If you were borrowing a boat from a friend, non-owned watercraft insurance could cover you against physical damage to other property and boats, as well as for lawsuits filed against you. This coverage may be available as a rider to a regular personal watercraft insurance policy, but can also be sold separately.

Now, if you were on vacation and the boat belonged to a resort, you'd need a different type of coverage entirely, known as boat rental insurance, which includes:

- Bodily injury liability: Protects you against causing injury to others with a rented boat.

- Property damage: Protects you against causing property damage to other vessels or different property with a rented boat.

- Wreckage removal: Protects you against costs that arise if a rented boat sinks and must be removed from the harbor.

A Tennessee independent insurance agent can help you get set up with the right kind of boat insurance to protect you no matter who the vessel you're operating belongs to.

What Does Boat Insurance Cover in Tennessee?

Boat insurance in Tennessee protects your boat, as well as you and other folks and their property. Tennessee watercraft insurance typically covers the following:

- Property damage liability: If you damage someone else's property, including their boat or something else like a fence or building with your boat, this coverage would protect you.

- Bodily injury liability: If you physically injure someone else while operating your boat, this coverage would protect you.

- Personal property damage: Covers your boat, trailer, and engine if any of these components get damaged by a covered peril like fire.

- Medical payments: Covers the treatment of injuries to you and your passengers who might get hurt during the operation of your boat.

A Tennessee independent insurance agent will make sure you get equipped with these coverages and any other types of boat insurance you may need.

What Doesn't Tennessee Boat Insurance Cover?

Boat insurance in Tennessee comes with exclusions, too, just like it would anywhere else. Tennessee boat insurance doesn't cover the following:

- Intentional incidents: No type of insurance will cover you if you intentionally cause harm to someone else or their property with your boat or anything else.

- Business-related incidents: Only commercial liability insurance would protect you if your boat got damaged or caused damage or injury while being used for business purposes.

- Non-owned watercraft incidents: As previously discussed, you may be able to add non-owned watercraft coverage to your policy as a rider, or you may need to purchase it separately.

Don't head out on the water or even dock your boat at a marina until it's equipped with the proper Tennessee boat insurance to protect you from unexpected costs.

Why Choose a Tennessee Independent Insurance Agent?

It’s simple. Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

collins.legal/blog/tennessee-boating-laws/#:~:text=Tennessee%20law%20does%20not%20require,%2C%20and%20non%2Dcollision%20damages.

statista.com/statistics/240641/recreational-boating-accidents-in-the-us-total-damages/

© 2024, Consumer Agent Portal, LLC. All rights reserved.