When you spend your days producing a crop that supports your farm and family, a loss can be devasting. Your harvest is your livelihood, and being proactive can help you avoid financial ruin. Tennessee crop insurance will have protection against flood damage to your bounty.

A Tennessee independent insurance agent has access to multiple markets so that you're met with the best policy. They'll even do the shopping for you, giving you premiums that won't break the budget. Connect with a local expert for tailored quotes to get started.

What Is Crop Insurance?

In Tennessee, $6,317,565,000 in commercial insurance claims were paid in just one year. When you don't have the right coverage for your crops, you'll have to pay the expense out of pocket.

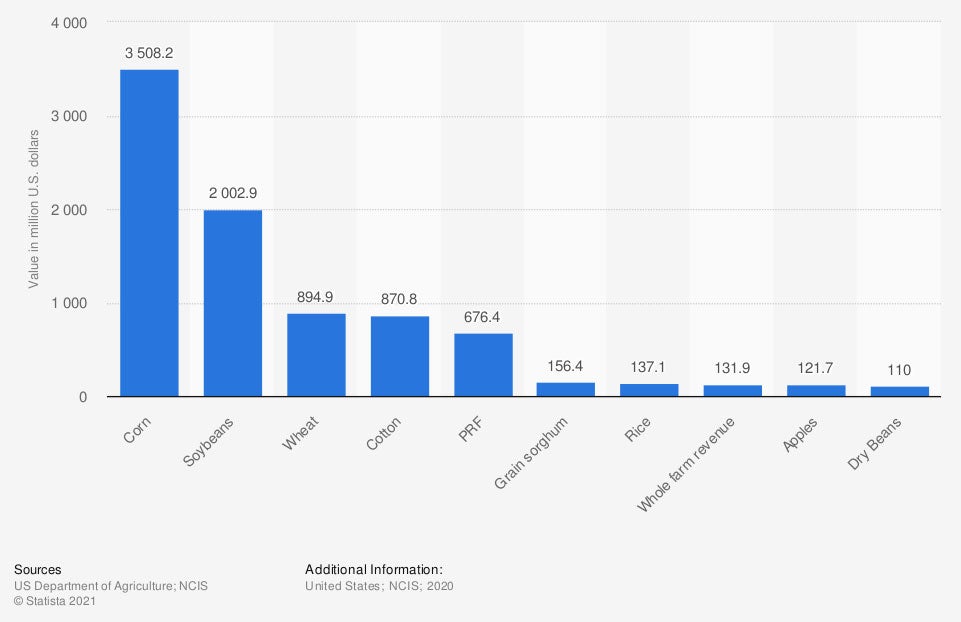

Value of crop insurance premiums in the US last year, by crop (in million US dollars)

Crop insurance premiums are part of doing business when you operate a farm. Fortunately, you'll have a trained adviser to help with coverage and rates.

What Does Crop Insurance Cover in Tennessee?

Your farm will have different crop insurance policies in Tennessee. Your primary crop policy is usually called multiple-peril crop insurance and covers numerous losses.

- Multiple-peril crop insurance: This policy will protect your crops from risks such as fire, severe weather, flooding, theft, vandalism, and more. When a loss occurs, the carrier will provide the funds to replace your crops.

What Doesn't Your Tennessee Crop Insurance 01Cover?

While it's good to know what your policies protect against, it's equally important to understand what they don't. Take a look at some standard exclusions when it comes to your crop policy:

- 20% of your crop value: There can be a type of coinsurance on a crop insurance policy where you'd owe the first 20% of the claim. The insurance company would cut you a check for the remaining 80%.

- Hail damage: Your crop insurance can cover a lot, including hail damage.

Does Crop Insurance Cover Flooding in Tennessee?

In Tennessee, your multiple-peril crop insurance will have coverage for flooding. This policy will pay for replacing your crops if a flood should occur, making your harvest unrecoverable. You'll want to discuss your crops' specifics with a knowledgeable adviser.

Items your adviser needs to know for multiple-peril crop insurance:

- Your crop specifications: What are your crops, where will you be storing them, how much is there, and how many acres will your crops occupy?

- What your crops are worth: How much will it cost to replace your crops before, during, and after the completed harvest?

- What preemptive protection you have in place: Are there special measures you take to ensure that your crops are safe from pests, wild animals, and predators? Are you using pesticides? What equipment are you using to care for your crops? Where are you storing your crops after growing and before distributing them?

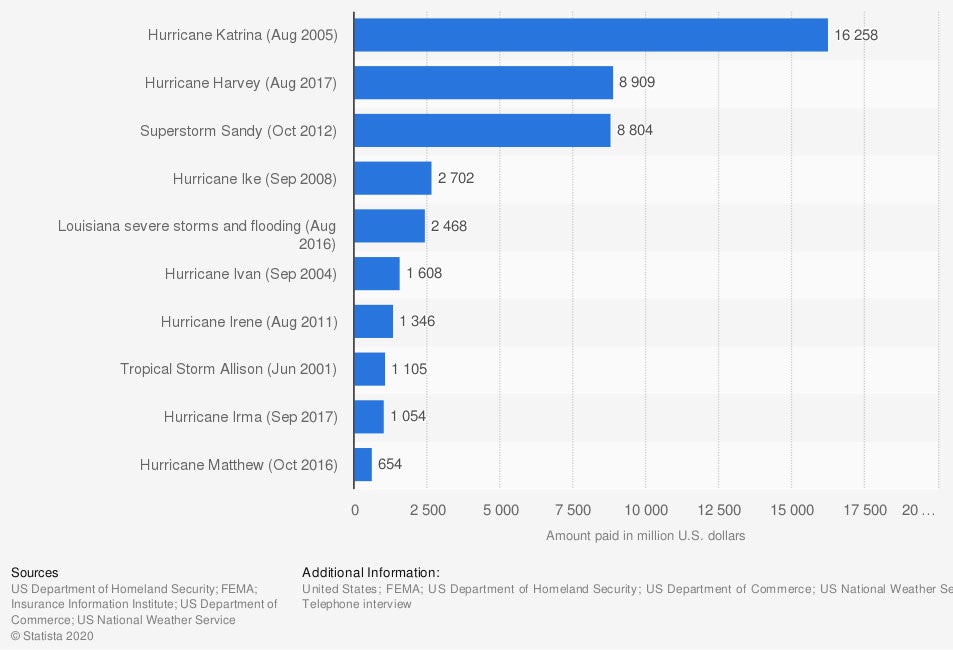

Most expensive flood disasters in the US, by National Flood Insurance Program (NFIP) payouts (in million US dollars)

Floods can happen to any farm, anywhere. The best way to be prepared is by being proactive with your coverage.

Additional Farm Policies to Consider in Tennessee

Protection for your farm as a whole is crucial to avoiding bankruptcy. One loss could destroy your production. Take a look at some additional coverage options in Tennessee that you may want to consider:

- Commercial umbrella insurance: This policy can be obtained for additional liability coverage above and beyond your underlying limits.

- Inland marine insurance for farm equipment: This can be added to any farm policy that uses equipment, tractors, and more for tending to their farm.

- Extended liability limits: You can increase your underlying liability limits for added coverage.

How an Independent Insurance Agent Can Help in Tennessee

If you've been hunting for the perfect crop insurance for your farm, you're not alone. Many carriers offer farm coverage so that you're not left out in the cold. A licensed professional can review and compare your policies for free to avoid gaps in coverage.

A Tennessee independent insurance agent does the shopping through their network of carriers, giving you access to the best. They'll find a policy that fits your budget so that you can relax. Connect with a local expert on trustedchoice.com for custom quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

https://www.statista.com/statistics/216501/most-expensive-us-flood-disasters/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.