When you're the proud owner of a home, numerous risks could get in your way. Things like severe weather or disasters are always around the corner. Fortunately, Tennessee homeowners insurance will help protect your roof from hail damage.

A Tennessee independent insurance agent has access to several carriers, so you don't have to. They'll do the shopping for free, making it a no-brainer. Connect with a local expert for tailored quotes in minutes.

Does Insurance Cover Hail Damage to Your Roof in Tennessee?

A standard Tennessee homeowners policy will come with coverage for fire, theft, vandalism, severe weather, and some water damage. The majority of property policies have the following limits of protection:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

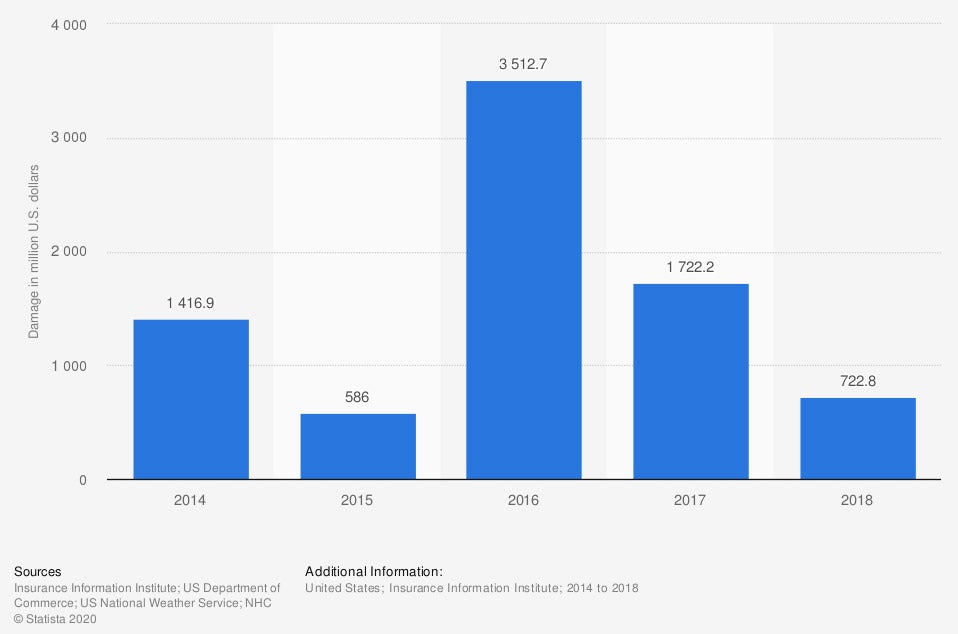

Property damage from hail in the US

Hail damage to your home and roof can be covered under your homeowners policy. The type of protection you'll have will be up to you beforehand.

What Does Hail Damage Look Like on Your Tennessee Roof?

In Tennessee, 1,153,112,000 homeowners claims were paid last year alone. It pays to know what hail damage to your roof looks like, so you're prepared. If you're finding little divots or dents in shingles that are discolored, then chances are you have hail damage.

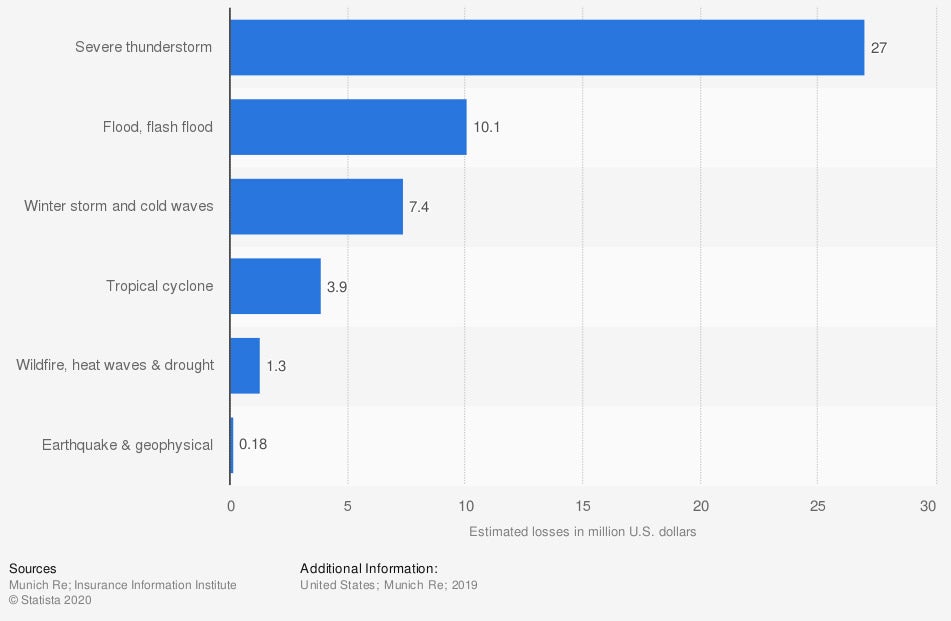

Estimated overall losses due to natural disasters in the US, by type

Natural disasters can create hail damage to your roof in a matter of seconds. If you get damage to your roof by hail or any other loss, it will be covered up to the preselected limit.

Do Your Homeowners Rates Increase in Tennessee after Hail Damage?

Your Tennessee homeowners insurance rates will go up after a hail damage claim. Carriers typically surcharge your policy for up 3 to years after the fact. Check out the average annual cost of homeowners insurance in the US:

- National average home insurance cost: $1,211

- Tennessee average home insurance cost: $1,196

How Much Does Insurance Pay for Roof Damage from Hail in Tennessee?

When it comes to hail damage to your Tennessee roof, your home policy will have a couple of coverage types. Check out the different values that could be used for repairing or replacing your roof:

- Replacement cost: Pays to replace your roof to its like kind and quality when a claim occurs, including hail damage.

- Actual cash value: Pays to replace or repair your roof to the current market value given the age of the roof. This usually applies when your roof is 15 years old or more.

How a Tennessee Independent Insurance Agent Can Help

In Tennessee, your homeowners insurance policy will have coverage for a variety of losses. From severe weather to catastrophes, including hail damage to your roof, protection can be pretty broad. A licensed professional can help review your coverage for free, making it super-simple.

A Tennessee independent insurance agent has a network of markets to compare policies and premiums with your best interests in mind. They'll even do the shopping for free, making it easy. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/1015618/property-hail-damage-usa/

https://www.statista.com/statistics/216836/estimated-overall-losses-due-to-natural-disasters-in-the-united-states/

http://www.city-data.com/city/Tennessee.html