If you own property, it can be a rewarding thing. While you can't predict what happens next, you can have coverage for it under your property policies. Tennessee homeowners insurance will have fire protection when it matters most.

A Tennessee independent insurance agent has access to multiple markets and presents the best rates and policy options. They'll even do the shopping for you at zero cost, making it a no-brainer. Connect with a local expert for custom quotes to get started.

What Is Fire Insurance?

In Tennessee, your property needs proper coverage for all the what-ifs. Protection from the elements is essential and should be reviewed for accuracy.

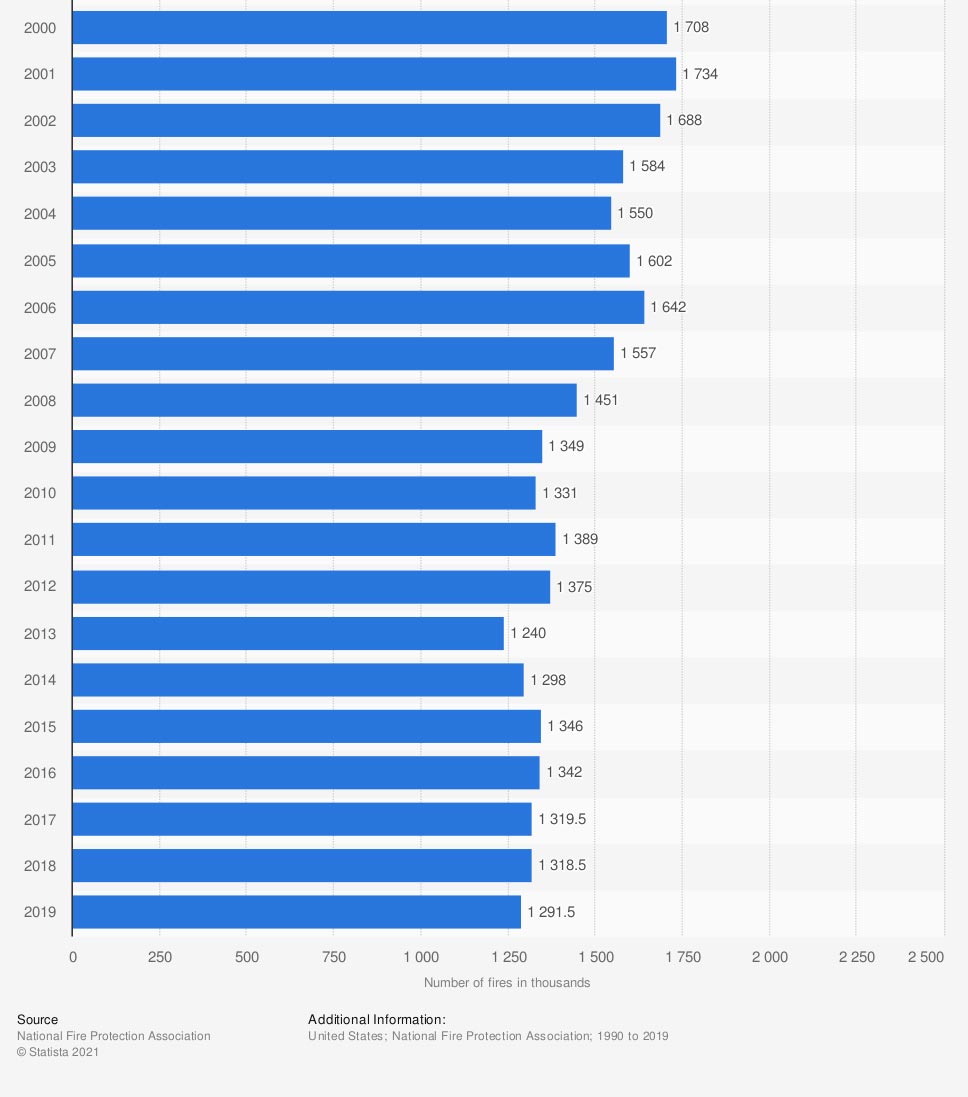

Total number of reported fires in the US (in 1,000s)

Fires are sometimes inevitable and can strike without notice. The only way to be prepared is by being proactive with coverage.

What Does Fire Insurance Cover in Tennessee?

Tennessee had 1,153,112,000 homeowners insurance claims paid out last year alone. You never know when a fire loss is about to happen, and understanding how your policy works is vital. Check out how fire insurance can help in the event of a loss.

What fire insurance covers:

- Replacement or repair of personal belongings

- Replacement or repair of business belongings

- Replacement or repair of your home

- Replacement or repair of your commercial property

- Replacement of repair of your vehicle

- Medical expenses caused by a fire

What Doesn't Your Tennessee Fire Insurance Cover?

Fire insurance is just one of many coverages you'll need for your property and belongings. Each carrier will have a list of losses they won't insure. Take a look at some standard exclusions when it comes to your fire coverage in Tennessee:

- Flooding: Flooding is insured under a separate flood insurance policy.

- Theft or vandalism: Theft or vandalism of your property is covered under your primary policy.

- Severe storm damage: Severe storm damage is covered under your primary policy.

Is My Tennessee Home Covered in the Event of a Fire?

Primary homeowners insurance in Tennessee will come standard with fire damage coverage. When your home gets destroyed by fire, you'll have coverage up to the limits preselected by you and your adviser.

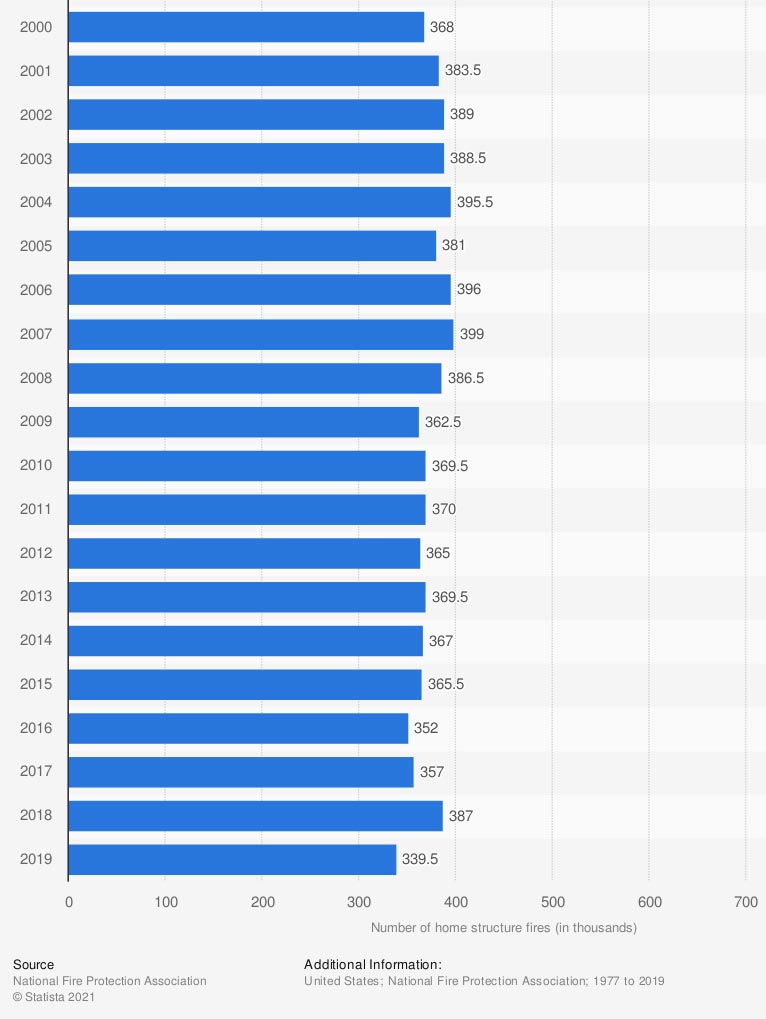

Total number of reported home structure fires in the US (in 1,000s)

All properties have a risk of fire loss. To ensure that you're fully prepared, go over your policy with a trained professional.

Is My Vehicle Protected with Fire Insurance in Tennessee?

In Tennessee, you're required by law to carry the minimum limits of liability at $25,000 bodily injury per person, $50,000 bodily injury per accident, and $15,000 property damage per accident. Comprehensive insurance will pay for your car's property damage due to severe weather, theft, and fire. Coverage for a fire loss is not included and has to be added.

Is My Commercial Property Covered under Fire Insurance in Tennessee?

When it comes to insuring your commercial property, there can be a lot of moving parts. Fortunately, your property policies will have protection against a fire damage loss. Insurance will pay for the replacement or repair of your business structures and belongings in most cases.

How an Independent Insurance Agent Can Help in Tennessee

Fires can wreak havoc on your owned property and create a substantial financial loss. There are several policy options to choose from, and it can be a challenge knowing what is necessary. To ensure that you have enough coverage for all that comes your way, consider using a licensed professional.

A Tennessee independent insurance agent does the shopping for you at zero cost. They have a network of carriers so that you're covered for every exposure. Connect with a local expert on trustedchoice.com to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/203760/total-number-of-reported-fires-in-the-united-states/

https://www.statista.com/statistics/376918/number-of-home-structure-fires-in-the-us/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.