There are several benefits to owning a company and living the American dream. While planning for every scenario that may occur to your operation can be difficult, doing so can prevent many heartaches. Tennessee commercial protection can include business interruption insurance for all the ups and downs.

A Tennessee independent insurance agent will have access to multiple markets so that you're fully prepared for a loss. They'll even do the shopping for free, giving you peace of mind. Connect with a local expert for custom quotes to get started.

What Is Business Interruption Insurance?

Your Tennessee business could be halted for numerous reasons. To ensure your entire operation doesn't get shut down, proper protection is necessary. Check out how business interruption insurance can help:

- Business interruption insurance: Pays for regular business expenses in the event of a covered loss. This coverage will help your company avoid closure.

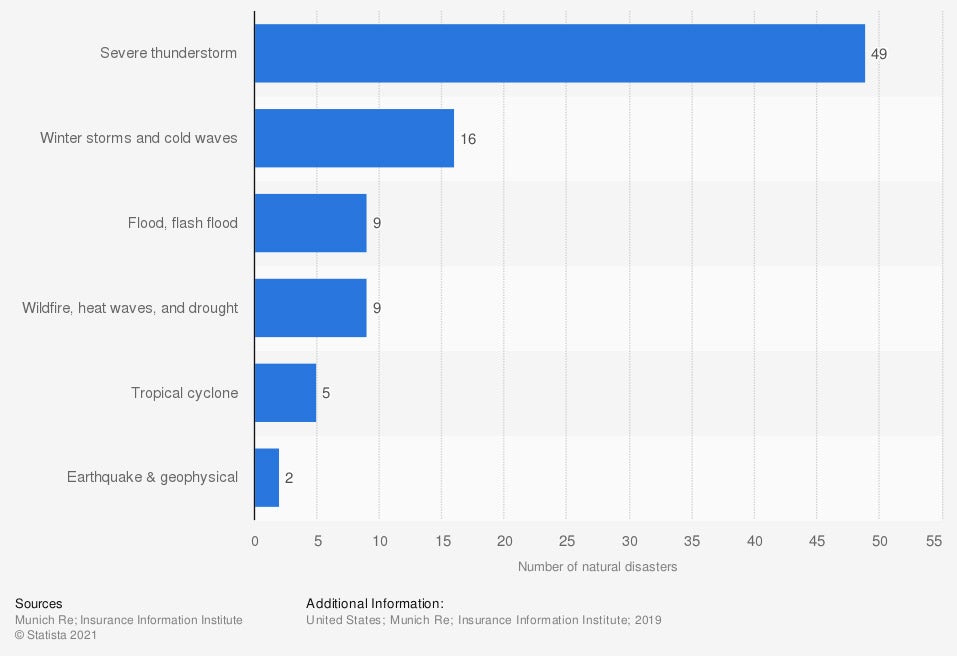

Leading risks to businesses in the US in recent years

When you have to stop services due to a loss, it can be easy to panic. Instead of being left out in the cold, go over your coverage options with a trusted adviser.

What Does Business Interruption Insurance Cover in Tennessee?

It's essential to understand what's covered under your commercial policies. When you know what to expect, you can better prepare for a claim. Business interruption insurance will protect the following items:

- Income: This is based on what your business would usually have made during the same time the previous year.

- Payroll: Any payroll you typically pay out to employees will be taken care of under this coverage.

- Taxes: If your loss occurs during tax season, you'll have coverage for business taxes due.

- Rent or mortgage: If the building you occupy is unusable, the rent or mortgage will be paid by this coverage.

- Relocation: If you have to move to a temporary location, business interruption will help pay the bill.

- Loans: Any loan payments you have incurred are part of this regular expense.

What Does Business Interruption Insurance Cost in Tennessee?

All business insurance policies will have different pricing. This is because every company has unique risk exposures that carriers use to calculate costs. Check out which disasters are most common in Tennessee:

Tennessee natural disasters that will impact your premiums:

- Severe storms and lightning damage

- Flooding and water damage

- Burglary and other property crimes

- Wildfires and residential fire

- Tornadoes

The number of natural disasters in the US by type

When a catastrophe occurs, it can not only put you out of business, it can also raise your premiums. The more losses historically in an area, the higher the insurance rates are.

Business Interruption Insurance Exclusions in Tennessee

In Tennessee, there are 603,310 small businesses in existence, all with different policies and risks. Each carrier will have a list of items they won't cover under your primary insurance due to the nature of the industry and other varying factors. Check out some standard exclusions that could apply to your Tennessee business interruption coverage:

- A pandemic: When a pandemic occurs, neither your business interruption nor any other commercial policies will provide coverage for closure.

- Flood insurance: If you don't currently have a flood insurance policy, you won't have coverage for flooding under your business interruption coverage. A separate flood policy is necessary.

- Earthquake insurance: If you don't have earthquake insurance before your business is compromised, interruption coverage won't cover damage for this. Limits can usually be added to your primary policies.

- Undocumented income: If your business is used to not leaving a paper trail, then you could be at a loss. Business interruption coverage only applies to income that you can prove.

What Is an Indemnity Period in Business Interruption Insurance in Tennessee?

Your insurance policies will provide coverage up to a specified amount or for a preselected limit of time. Business interruption insurance will use a time frame called the indemnity period.

- Indemnity period: The amount of time a specific coverage will pay out a covered loss.

Business Interruption Insurance and Extra Expense Coverage in Tennessee

In Tennessee, business interruption insurance will come with an option to add coverage for extra costs that may occur. If you have to shut your business down for an extended period, additional expenses coverage can help pay for items you may not have taken into account.

- Extra expense coverage option: This will pay for additional costs outside your regular business expenses caused by a covered claim.

How to Connect with an Independent Insurance Agent in Tennessee

When it comes to insuring your Tennessee business, there are various policy options and coverages. It can be challenging to know what's necessary and what's just fluff. Fortunately, a licensed professional can help review your policies for gaps at no additional cost.

A Tennessee independent insurance agent has a network of carriers, providing you with options on coverage and premium. They'll even do the shopping for free. Connect with a local expert on trustedchoice.com and start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/422203/leading-business-risks-usa/

https://www.statista.com/statistics/216819/natural-disasters-in-the-united-states/

http://www.city-data.com/city/Tennessee.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.