Chiropractors relieve pain and improve function through manipulating the spine and other alternative treatments. While they're experts on the skeletal system, the wrong adjustment can leave someone in more pain than before. That's why chiropractors need chiropractor liability insurance.

Tennessee independent insurance agents understand the risks you face in your chiropractic office. They can get you set up with the right chiropractic liability insurance long before you need it. Here's why you should consider this coverage.

Do Chiropractors Carry Malpractice Insurance?

According to insurance expert Jeffrey Green, some states require that chiropractors carry malpractice insurance. Those states include Connecticut, Florida, Kansas, Massachusetts, Oklahoma, Pennsylvania, South Dakota, and Wisconsin.

While Tennessee chiropractors do not have to carry malpractice insurance by law, it's important to be protected against potential risks. For chiropractors that risk includes being sued by a patient for negligence or causing an injury.

Malpractice insurance is the only way to ensure that a mistake won't end up costing you your career or life savings.

What Does Chiropractors Liability Insurance Cover in Tennessee?

Chiropractors liability insurance is a type of professional liability insurance that helps pay for fees and costs associated with being sued by a client. Specifically, it will cover things like court costs, legal fees, damages, settlements, and any other financial obligations.

Here are a few of the mistakes that a chiropractor could make:

- Bodily injury because of negligence: When this occurs a patient claims that the chiropractor's adjustments resulted in a new injury or worsened the existing injury.

- Induction of a stroke: When a client claims the adjustment from the chiropractor led to a stroke.

- Failure to diagnose a medical condition: When a client claims the chiropractor failed to diagnose an underlying medical condition.

- Lack of consent: When a chiropractor fails to properly educate the client on the potential risks of the treatment and the patient ends up with an injury.

All of the above scenarios can result in a malpractice liability claim. A Tennessee independent insurance agent can go into further detail about the risks that chiropractors face.

What Doesn't Chiropractors Liability Insurance Cover in Tennessee?

Tennessee chiropractors will receive a long list of coverages from their chiropractors liability insurance, but there are some exclusions. These include:

- Alteration of records

- Criminal acts

- Intentional and dishonest acts

- Sexual misconduct

Before you purchase any insurance policy, it's necessary to understand what is and is not covered. Every carrier is different, so your Tennessee independent insurance agent can help you understand how your policy is written.

How Much Do Chiropractors Pay for Malpractice Insurance in Tennessee?

Insurance rates are always based on a variety of risks that will affect every person and business differently. For chiropractors, malpractice insurance prices will depend on where you live, prior claims history, and the services you offer.

The good news is that the less risky your career, the lower your insurance premiums will be. Chiropractors are much less likely to have malpractice lawsuits against them than surgeons, and therefore will pay significantly less in premium costs.

Direct premiums of medical professional liability insurance market in the US by state (in million US dollars)

In 2018, Tennessee earned $207 million in direct premiums for medical professional liability insurance.

If you want to collect multiple pricing quotes before making a decision, a Tennessee independent insurance agent can shop carriers for you.

Best Malpractice Insurance for Chiropractors

When you purchase chiropractors malpractice insurance you'll have the option to choose between a claims-made policy and an occurrence policy. Both have different benefits.

- Claims-made policy: Provides coverage only if the claim is made while the policy is still active and during the policy term.

- Occurrence policy: Provides coverage for any claims where the event takes place during the period of coverage. However, the claim can be filed outside of the period of coverage.

Most malpractice insurance is claims-made but it's still important to understand the difference and discuss what will work better for you with your insurance agent.

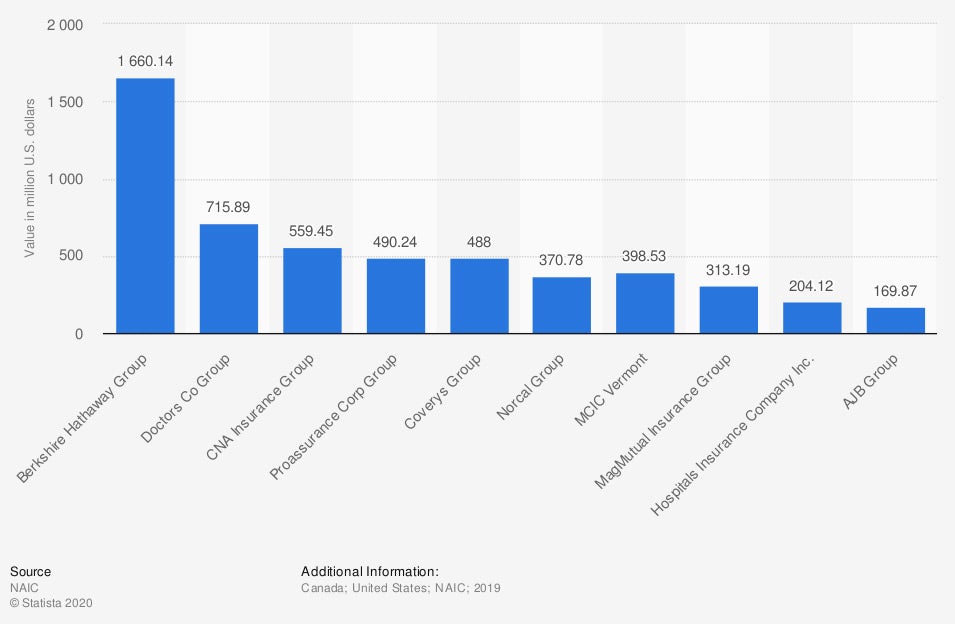

Leading medical professional liability insurers North America 2019, by premiums

In 2019, the largest North American medical malpractice insurer was Berkshire Hathaway Group with $1.66 billion in direct premiums written.

How Can a Tennessee Independent Insurance Agent Help?

A malpractice lawsuit can end your career. Finding the right chiropractors liability insurance is a crucial step in getting your practice off the ground on the right foot. A Tennesee independent insurance agent is the best way to make sure you're protected before you start practicing.

They'll shop multiple carriers and provide you with several quotes to choose from. If you end up with a malpractice lawsuit, your agent will be there to walk you through the claims process. Find an independent insurance agent in Tennessee today.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.fclb.org/AboutCINBAD/CINBADOverview/Malpractice/tabid/488/Default.aspx

https://www.gallaghermalpractice.com/state-resources/tennessee-medical-malpractice-insurance/

https://www.chirosecure.com/the-importance-of-medical-malpractice-insurance-for-chiropractors

© 2024, Consumer Agent Portal, LLC. All rights reserved.