Your corn farm needs protection from many different angles to run efficiently. From the corn crops themselves to the structures on your property, many aspects need their own coverage against disaster. That’s why having the right corn farm insurance is so important.

Fortunately a Tennessee independent insurance agent can help you prepare for unforeseen catastrophes and get you set up with the corn farm insurance you need. Even better, they’ll get you covered long before you ever have to file a claim. But first, here’s a closer look at this important coverage.

What Is Corn Farm Insurance?

Corn farm insurance is basically a special type of Tennessee farm insurance customized to meet the needs of corn farms. Policies include the basics of Tennessee business insurance and then add extra coverages to meet the specific needs of your corn farm. Coverage applies to crops, property damage, and more. A Tennessee independent insurance agent can help you find the right coverage for your unique corn farm’s risks.

What Does Corn Farm Insurance Cover in Tennessee?

According to insurance expert Paul Martin, corn farm insurance policies may vary by the carrier who offers them. You’ll also be working with your Tennessee independent insurance agent to assemble the package that best works for you. But there are a few common coverages offered in many corn farm insurance policies, like:

- Property insurance: Your fencing, farmhouses, storage sheds, etc. need property coverage against disasters like storms and vandalism.

- Liability insurance: Your corn farm also needs protection from a legal standpoint against unexpected lawsuits filed by third parties for claims of personal property damage or bodily injury.

- Equipment coverage: Your mowers, plows, and other special equipment need their own coverage against many threats, from theft to fire and beyond.

These are just the basics of coverage provided by a corn farm policy in Tennessee. You may have to add several types of coverage to get the fullest picture of protection.

Are There Other Policies That Can Provide Additional Protection?

Yes, and you'll probably need to add a few coverages to the basics included in your corn farm policy. Some popular add-ons to corn insurance are:

- Workers’ compensation: Even though Tennessee doesn’t legally require agricultural businesses to have workers’ comp coverage, your team needs to be protected against injury, illness, and death on the job.

- Crop insurance: Crop insurance is critical to protect your corn from hazards like freezing, fire damage, theft, etc. Without the right coverage, just one disaster could wipe out your corn crops, and have a devastating toll on your farm.

- Commercial auto insurance: Your corn farm also needs special protection for company vehicles that are taken out on the road. Your personal auto insurance policy will not protect them.

Your Tennessee independent insurance agent will assist you in choosing the right additional coverages for your specific corn farm.

Stats for the Corn Farm Industry

When shopping for coverage for your corn farm, it’s helpful to be familiar with just how much your industry is growing. Check out some stats for the corn farm industry in the US below.

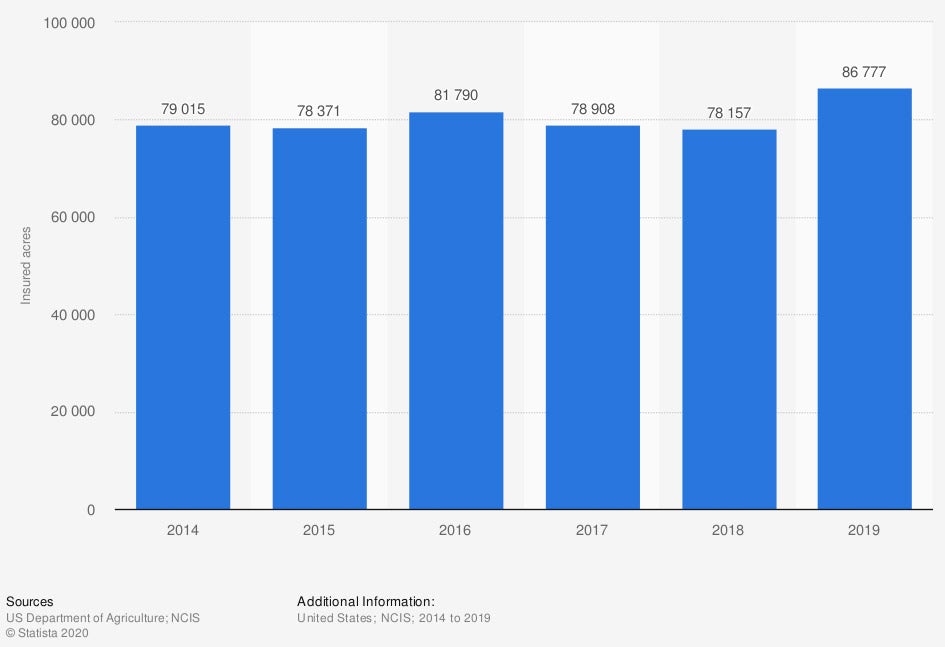

Volume of insured acres of corn in the US from 2014 to 2019

The amount of insured acres of corn in the US has been increasing over the past few years. In 2014, there were 79,015 acres of insured corn crops in the country. By 2019, this number had grown to 86,777 insured acres.

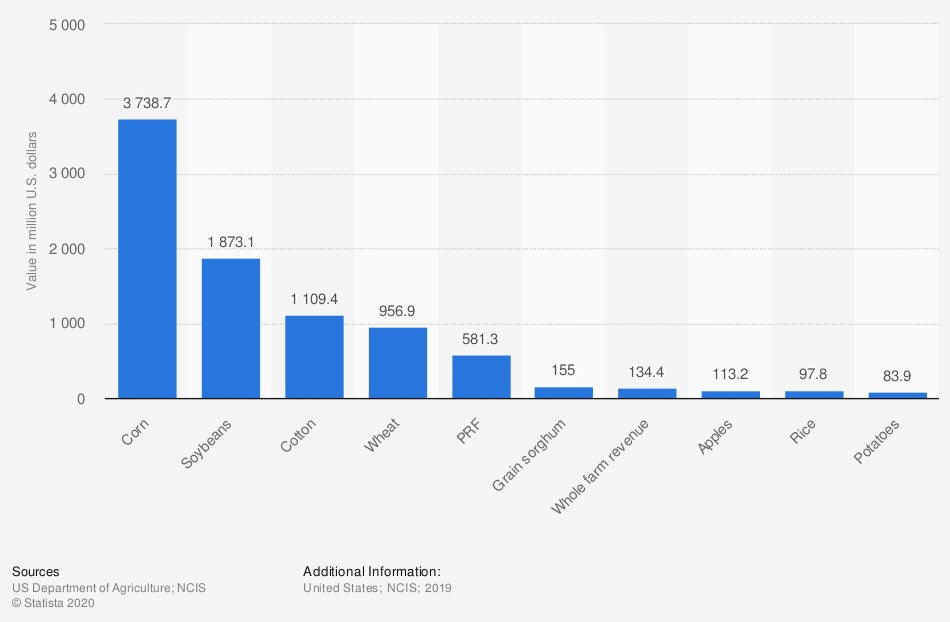

Value of crop insurance premiums in the US in 2019, by crop (in million US dollars)

Corn crops in the US have by far the highest values for insurance premiums. In 2019, the value of insured corn crop premiums was $3.74 billion. Second-highest was soybean crops, at just about half that value, $1.87 billion.

Since the number and value of corn crops across the country continues to increase, it’s crucial to make sure your corn farm is equipped with the proper coverage.

What Isn’t Covered by Corn Farm Insurance in Tennessee?

Corn farm insurance provides a lot of critical protection, but it also comes with exclusions. While exclusions may vary by policy, some common examples are:

- Maintenance-related losses

- Improper upkeep of property and equipment

- Nuclear fallout or war damage

- Insect damage or infestations

- Earthquake damage

- Flood damage

Your Tennessee independent insurance agent will help you get equipped with all the protection you need to feel like your corn farm is secure. This may involve adding a separate flood insurance policy.

What Are Some Common Risks to Corn Farms in Tennessee?

Corn farms can be hit by numerous disasters that all need to be planned for in advance. Here are just a few:

- Legal issues: If a guest or other third party claims to have been harmed by your farm in some way, you could end up with a lawsuit on your hands. Fortunately your corn farm policy provides liability coverage to pay for attorney and court costs.

- Physical damage: Storms, vandals, or even reckless livestock could damage your crops or other property, which is why the commercial property coverage section of your corn farm insurance is so important.

- Monetary issues: Many disasters could affect your corn farm’s revenue as well, from theft to storms and injured employees. Fortunately the right corn farm insurance can help safeguard your profits.

Your Tennessee independent insurance agent can discuss how your policy will protect your corn farm against common disasters.

Here’s How a Tennessee Independent Insurance Agent Can Help

When it comes to protecting corn farms against hazards like hail, theft, vandalism, fire, and all other disasters, no one’s better equipped to help than an independent insurance agent. Tennessee independent insurance agents search through multiple carriers to find providers who specialize in corn farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/723030/volume-of-insured-acres-of-corn-usa/

https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

https://www.iii.org/article/understanding-crop-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.