There are many farms in Tennessee, and proper coverage is necessary to be fully protected. As a farmer, you'll have multiple policies to choose from, and it can be challenging to know what applies. Tennessee farm insurance will have coverage for your crops.

Fortunately, a Tennessee independent insurance agent can help with policy and premium options. They do the shopping for you at no additional cost so that you can relax. Connect with a local expert for custom quotes today.

What Is Crop Insurance?

Crop insurance is separate from your farm coverage. Sometimes it can be included under your other commercial policies, but that depends on what the carrier offers. Crop insurance will protect your bounty from storm damage, among other things.

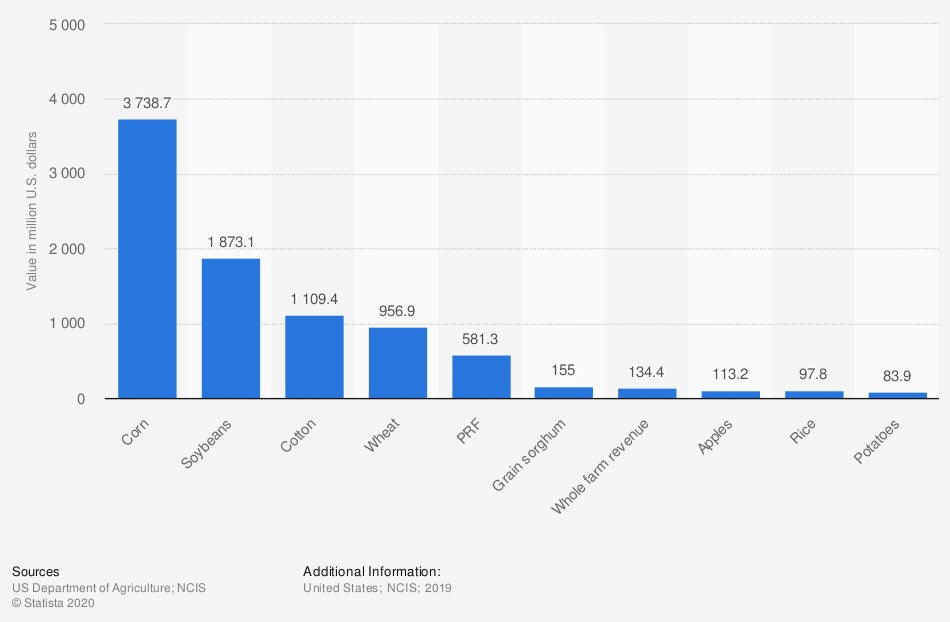

Value of crop insurance premiums in the US, by type (in million US dollars)

It's good to understand which crops generate the most in premiums for crop insurance. There are several carriers to choose from when selecting your crop coverage.

What Does Crop Insurance Cover in Tennessee?

When you need to insure your crops from damage or disaster, there are a few things you should know. What your crop insurance covers is at the top of the list.

What your crop insurance generally covers:

- Severe storm damage

- Tornado damage

- Fire damage

- Theft

- Vandalism

What Doesn't Crop Insurance Cover in Tennessee?

It's equally important to be aware of what's not covered under your crop insurance. Take a look at some standard exclusions when it comes to your coverage:

- Flooding: Not all flooding is covered by crop insurance, so knowing your policy offerings is imperative.

- 20% of your crop value: There can be a type of coinsurance on a crop insurance policy where you'd owe the first 20% of the claim. The insurance company would cut you a check for the remaining 80%.

- Hail damage: You will need a separate crop-hail insurance policy to have coverage for hail damage to your crops.

Common Crop Risks in Tennessee

Whether you have a modest few acres of wheat or you're a major soybean producer in Tennessee, you'll need to know your risk exposures.

Your independent insurance agent will need to know the following to get started:

- Your crop specifications: What are your crops, where will you be storing them, how much is there, and how many acres will your crops be occupying?

- What your crops are worth: How much will it cost to replace your crops before, during, and after the final completion of your product?

- What preemptive protection you have in place: Are there special measures you take to ensure that your crops are safe from pests, wild animals, and predators? Are you using pesticides? What equipment are you using to care for your crops? Where are you storing your crops after growing and before distributing them?

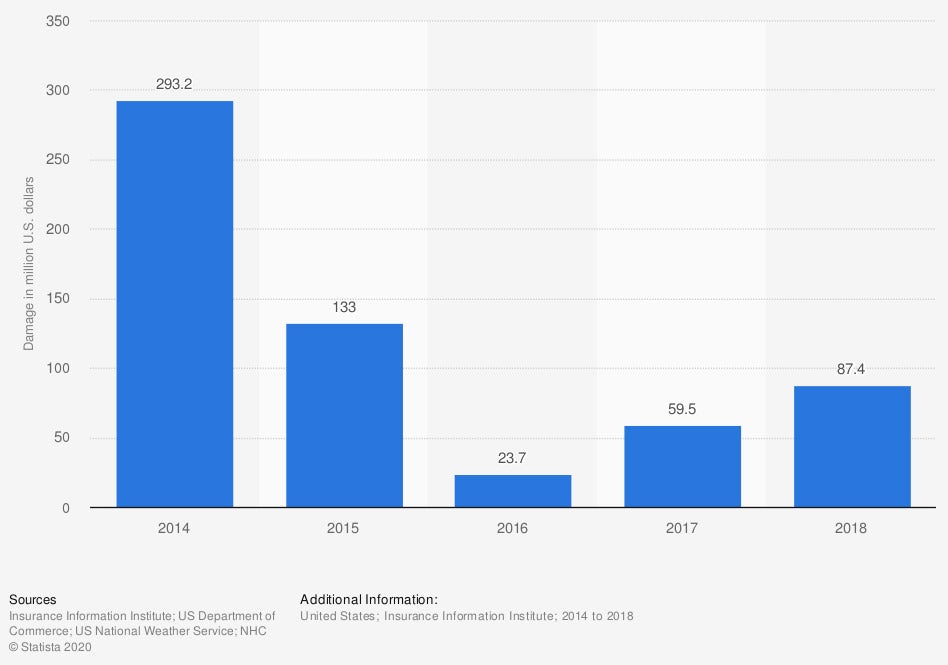

Crop-hail damage in the US from 2014 to 2018 (in million US dollars)

This shows just the effects of hail damage on crops in the US. There are several other elements that you'll want protection from when you have a farm with crops. Consider consulting with a trained adviser to have proper insurance.

How an Independent Insurance Agent Can Help in Tennessee

If you're searching for farm protection that fits your operations and budget, consider working with a trusted professional. As a farm owner, there are several policies that you may need to be properly covered. Crop insurance will be necessary if you want adequate protection.

Fortunately, a Tennessee independent insurance agent can help you find a policy for an affordable price. They'll review your coverage for free, making sure you're obtaining sufficient crop insurance. Connect with a local expert on TrustedChoice to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

Graphic #2: https://www.statista.com/statistics/1015612/crop-hail-damage-usa/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.