In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019. When you run a company, you're responsible for all that could go wrong. Tennessee business insurance will usually include some type of inland marine coverage.

Fortunately, a Tennessee independent insurance agent can help with policy and premium options. They work with a network of carriers so that you don't have to. Get connected with a local expert for tailored quotes today.

What Is Inland Marine Insurance?

Your property in transit will need inland marine insurance, among other items. This policy is separate from your Tennessee commercial property insurance, and both are usually necessary.

- Inland marine insurance: Replaces or repairs your business property when a covered loss occurs. This could be from heavy machinery to tools in transit. The items insured will depend on the policy and the carrier.

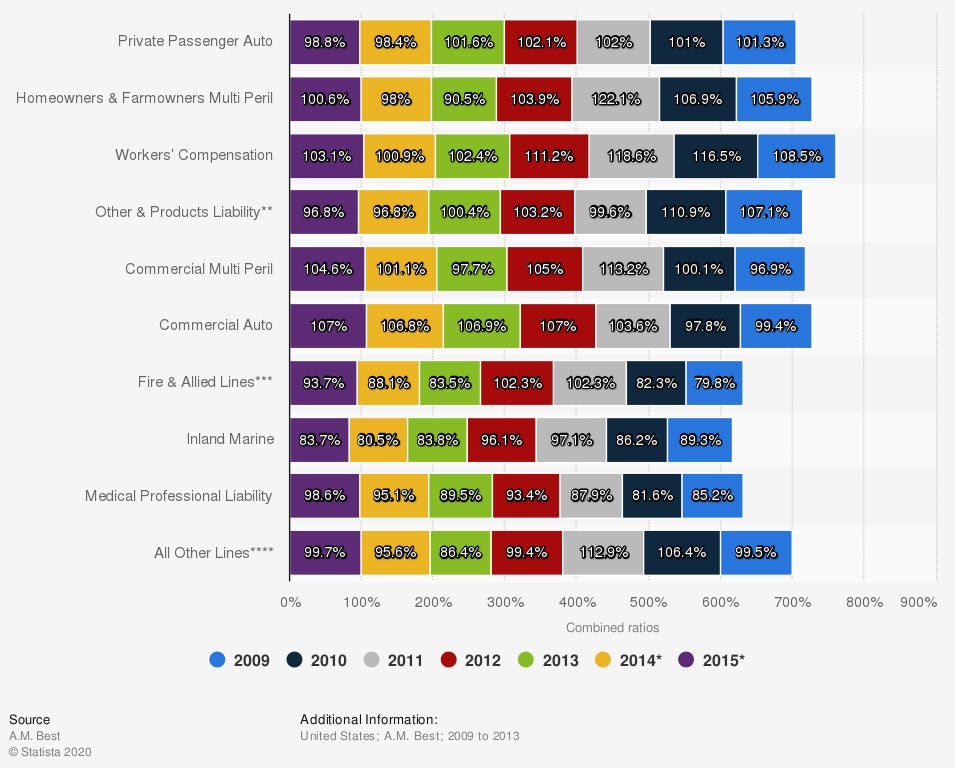

It's essential to understand how common inland marine coverage is for your business. The ratios of property/casualty insurance in the nation are below:

Combined US ratios of property/casualty insurance

Your policy will be specific to your operation. It's important to know what your inland marine policy will cover.

What Does Inland Marine Insurance Cover in Tennessee?

Tennessee inland marine insurance is unique to your business. Special inland marine coverage will insure different business types depending on your industry. Some examples of are as follows:

- Bailee's insurance: Used for client property that is left in the care, custody, and control of your business.

- Builders risk insurance: Used to protect the property and materials used when building a structure.

- Installation insurance: Used when items are in transit up until they are installed. Also known as in-transit coverage.

There are typical risks that are covered under your Tennessee inland marine policy and automatically included. These are common perils that occur most often.

- Fire

- Wind

- Hail

- Theft

- Water damage

Every carrier will allow different things when it comes to coverage. Other key items that may not be included but can usually be added are as follows:

- Mysterious disappearance: Pays for missing property when the cause of loss can't be discovered.

- Accidental damage: Pays for replacement or repair when an item is dropped. This can be in transit or when loading or unloading.

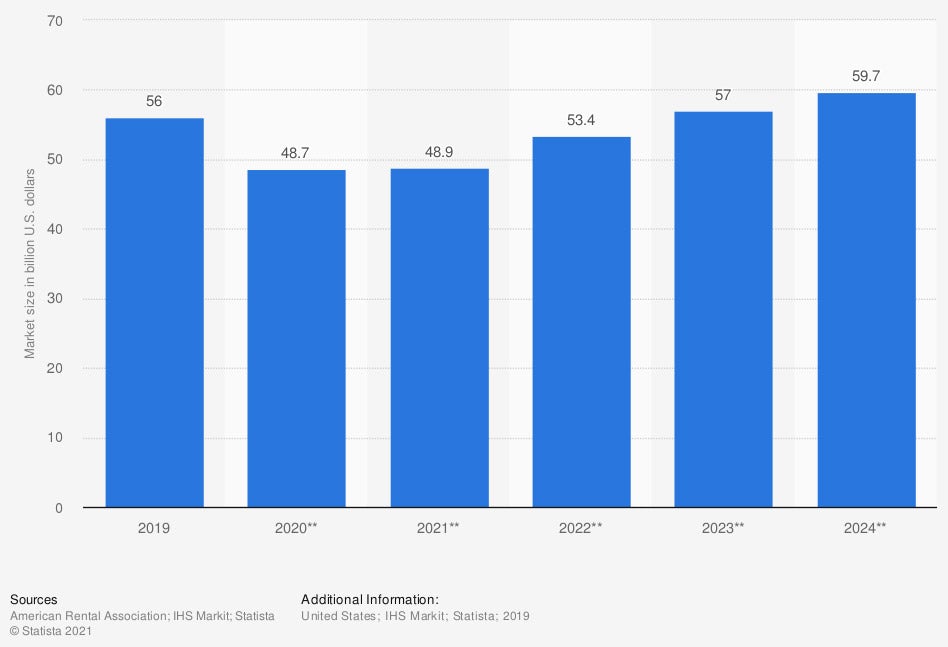

Things like contractor's tools, contractor's equipment, computer systems, sales equipment, and heavy machinery should be insured under an inland marine policy. Take a look at the rental equipment market below:

US rental equipment market (in billion US dollars)

How Much Does Inland Marine Insurance Cost in Tennessee?

Similar to your other commercial policies, prices for coverage will vary. Insurance companies use several different risk factors when quoting your inland marine policy. Take a look at what carriers use when determining price:

- Value of items

- Prior claims

- Coverage limits

- Risk mitigation measures

- State claims records

Does Inland Marine Insurance Cover Theft in Tennessee?

Fortunately, a Tennessee inland marine policy usually comes standard with theft and vandalism coverage. When you're dealing with equipment and property in transit, the right insurance can save you hundreds of thousands of dollars. If your items get stolen at a job site or something similar, this policy will pick up the expense minus deductibles.

Personal Inland Marine Insurance

Tennessee primary homeowners insurance can have a spot to add inland marine coverage for your personal items. If you have a claim, it will be filed under your home policy and affect your homeowners insurance rates. Personal inland marine insurance will typically come without a deductible and schedule your more expensive property for an appraised value. See what's usually listed under this policy type:

- Furs

- Guns

- Artwork

- Jewelry

- Jewels

- Golf clubs

- Musical instruments

How to Find a Tennessee Independent Agent

When it comes to securing Tennessee business insurance, there's a lot to know. Fortunately, a trusted adviser can help for free. They do the shopping at no cost to your business, making inland marine insurance a breeze.

A Tennessee independent insurance agent will have access to multiple carriers so that you can save. They'll do all the work while you run your company. Connect with a local expert on TrustedChoice to get started today.

Article Author and Expert | Candace Jenkins

Graphic #1: https://www.statista.com/statistics/437171/combined-ratios-pc-insurance-usa-by-product-line/

Graphic #2: https://www.statista.com/statistics/248725/us-equipment-rental-market-size/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.