If your business relies heavily on one or a few people to function, then you have key people that could cause financial turmoil to your company if they should unexpectedly pass away. That's why it's important to protect your key people with the proper insurance coverage.

Key person insurance is not for everyone, but for Tennessee business owners who need this coverage, a Tennessee independent insurance agent is the right place to start. They'll find you protection before you need it. Let's learn more.

What Is Key Person Insurance?

Key person insurance is like life insurance but for employees and purchased by a company. If you have an employee that is considered invaluable to your company, you can purchase an insurance policy that will pay out a death benefit should that person become terminally ill or pass away.

According to insurance expert Paul Martin, key person insurance is popular for organizations with a few owners where everyone contributes to the wealth and prosperity of the company.

"If one person dies, that's a huge loss," said Martin. "If that person is so important to the company that their death would cause you financial harm, then you have an insurable interest and should purchase key person insurance."

What Does Key Person Insurance Cover in Tennessee?

A key person can bring a number of valuable assets to a company. Maybe it's a co-owner who brings in 50% of the revenue, or maybe it's someone who is the face of your company while doing tours. Should this person pass away, the death benefit can be used for a variety of things, including:

- Paying regular expenses while the company restructures

- Necessary costs while the company finds a replacement

- Lost revenue

- Paying off debt

- Paying investors

- Paying for employee salaries or severance

The National Association of Insurance Commissioners reported that while 71% percent of small businesses in a survey said they were very dependent on one or two key people for their success, only 22% had key person life insurance in place.

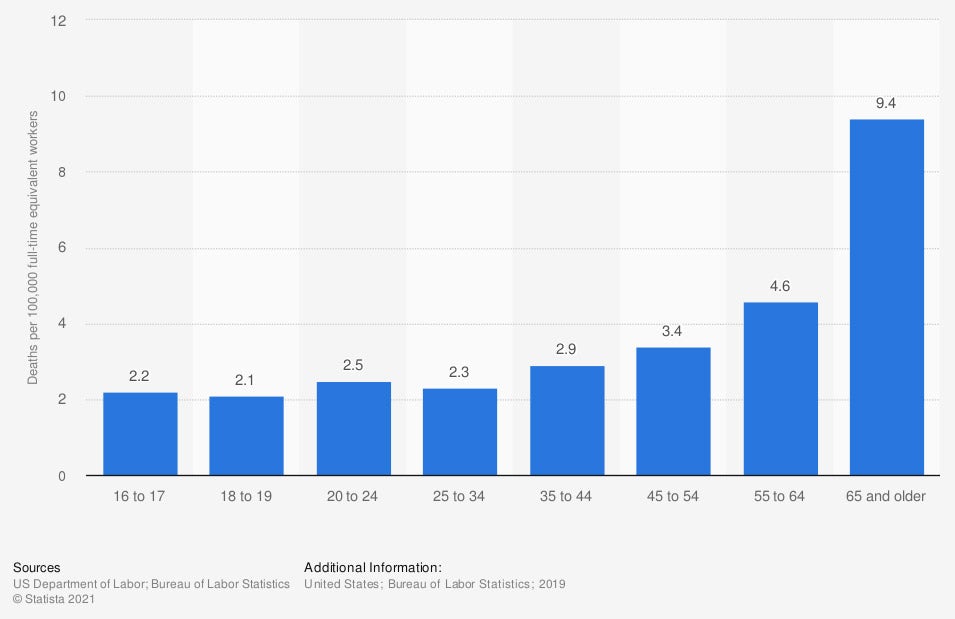

Occupational injury deaths per 100,000 full-time equivalent workers in the US in 2019, by age

In 2019, the occupational injury death rate for workers aged 65 and older stood at 9.4. Fatal work injury rates for workers 55 years of age and over were higher than the overall US rate of 3.5, and the rate for workers 65 years of age and over was almost three times the rate for all workers.

What Does Key Person Insurance Cost in Tennessee?

There is no set amount for how much key person insurance you should purchase. Premiums are based heavily on the amount of death benefit you're buying, so no two policies will be the same.

The three main factors that affect key person insurance cost are the employee's individual characteristics, the type of policy, and the death benefit amount.

- Employee characteristics: Just as with a personal life insurance policy, a person's risk factors for dying play a major role in key person insurance cost. Ultimately, the healthier and less risky a person is, the less insurance will cost.

- Policy type: Your company will have the option to choose between a temporary or permanent key person insurance policy. Term policies tend to cost less because they are only for a specified amount of time. However, permanent policies can accumulate cash value, so there are benefits to both types of coverage.

- Death benefit amount: A policy with a $200,000 death benefit will naturally cost less than a policy with a $1,000,000 death benefit.

Your Tennessee independent insurance agent can help you determine the right amount of key person insurance to purchase, and how much it will cost.

What Are the Benefits of Tennessee Key Person Insurance?

A key person can be more than just the owner of a company. Key people can include founders, partners, managers, spokespeople, key salespeople, and more. Plus, the death benefit can be used for more than just replacing revenue.

- Example 1: You're a small business with four owners. In the owner contract, it says that if an owner should pass away the business will be left to their spouse. In a tragic event, one owner passes, and the remaining three owners are left running the business with the spouse, who knows nothing about the industry. The death benefit from key person coverage can be used to buy out that spouse.

- Example 2: You have a self-help business that is modeled after one person's life training. Your business consists of this person traveling around the world, providing teaching and seminars. They're the face of the company. Should they pass away, you'll lose your teacher, traveler, and the face of the company and will need to start over.

- Example 3: You're a refrigerator sales company with three salespeople. One person brings in 75% of sales revenue and they pass away. Without that revenue, your company could be in danger of quickly closing its doors.

Key person insurance provides financial security to companies that rely heavily on key people and the value they provide.

What Is Key Person Disability Insurance?

A key person disability insurance policy in Tennessee is similar to a key person life insurance policy, except the payout is in the event that the employee becomes disabled and is unable to continue their job.

In the event that a key employee does become disabled, the company can use the benefits for things like:

- Temporary staffing costs

- Office expenses

- Employee replacement costs

- Showing stability to investors or creditors

- Offsetting other costs of losing the employee

- Salaries

If an individual has key person disability insurance, they are still able to purchase individual disability insurance as well.

Employment of disabled people in America

Are Key Person Life Insurance Premiums Tax-Deductible in Tennessee?

According to the Internal Revenue Service, life insurance premiums, including those on key employees, are not tax-deductible. However, the benefit will be given to the company tax-free.

For this reason, it's best to work with your Tennessee independent insurance agent to fully understand the implications and costs associated with purchasing key person insurance.

How a Tennessee Independent Insurance Agent Can Help

Tennessee is home to more than 600,000 small businesses that employ more than one million people. If you've got an employee you know you can't afford to lose, a Tennessee independent insurance agent can help you find key person insurance today.

They'll shop multiple carriers, and can suggest discounts and ways to keep your premiums affordable without sacrificing coverage. Work with a Tennessee independent insurance agent today.

Author | Sara East

Article Reviewed by | Paul Martin

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

https://www.bls.gov/news.release/pdf/disabl.pdf

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/life-insurance-for-key-employees

© 2025, Consumer Agent Portal, LLC. All rights reserved.