When you occupy a home, business, or other property, you'll be responsible for what happens there. Sometimes you may not even be at fault, but it could still be your problem. Fortunately, Tennessee business insurance will come with premises liability protection for all the what-ifs.

A Tennessee independent insurance agent works with dozens of carriers to find a policy that suits your needs and budget. They'll shop your coverage for free, making it a no-brainer. Connect with a local expert for custom quotes in minutes.

What Is Premises Liability Insurance?

If you rent or own a structure in Tennessee, there's a lot at stake. Anything that occurs at the location, with or without you knowing it, could result in a lawsuit.

- Premises liability insurance: Pays for losses arising out of bodily injury and property damage that occur on your premises. This can be due to hazards or negligence on your end.

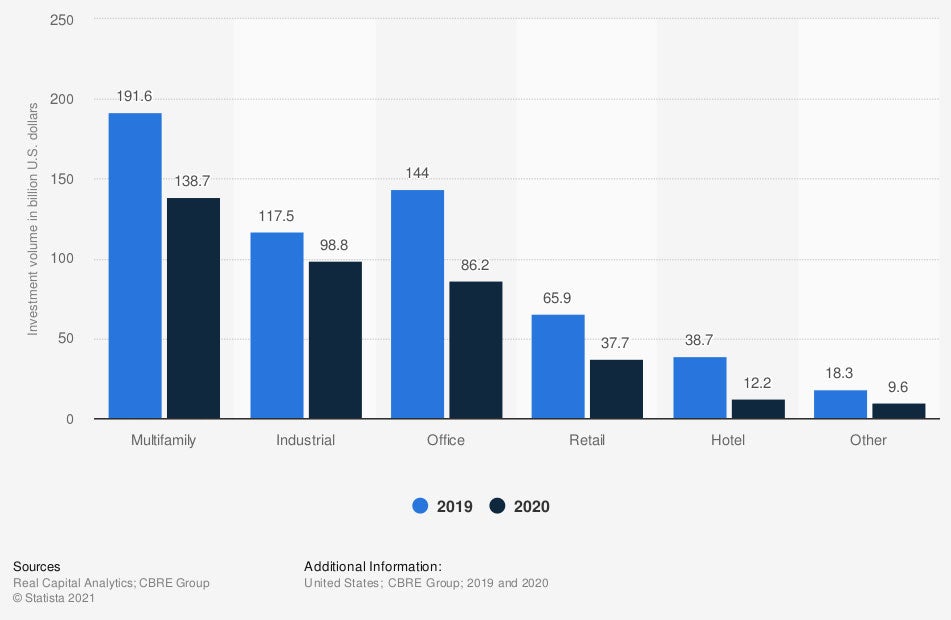

Value of commercial real estate investments in the US, by property type

The type of property you own will determine how much liability exposure you have. The higher the risk, the better protection you need in place.

What Does Premises Liability Insurance Cover in Tennessee?

Each commercial policy will come with individualized coverage options depending on your specifications and risk. Check out standard premises liability policy options in Tennessee:

- Bodily injury coverage due to an accident

- Bodily injury coverage due to the owner's negligence

- Bodily injury coverage for a trespasser

- Bodily injury coverage for a customer

- Bodily injury coverage for a guest or friend

What Doesn't Premises Liability Insurance Cover in Tennessee?

Your Tennessee premises liability policy won't have coverage for every loss that may occur. Some common exclusions under your premises liability insurance are:

- Employee injuries: This would fall under workers' compensation insurance.

- Intentional damage: If you intentionally damage your own business property, there is no coverage under this policy, or any other policy for that matter.

- Medical malpractice injuries: If you are a physician and injure a party medically, this would not fall under premises liability. Instead, you would need a medical malpractice policy.

Commercial Premises Liability Insurance in Tennessee

Tennessee premises liability insurance has coverage for several different instances that come your way. It's essential to know what a premises liability loss looks like. Some examples of potential lawsuits are as follows:

- Not covering up a hole on your premises

- Leaving dangerous equipment out in the open

- Having unrestricted access for the public

- Not displaying cautionary signs and warnings

- Leaving hazardous materials unattended

- No sprinkler system for a fire

Premises Liability Insurance vs. General Liability Coverage in Tennessee

Your premises liability and general liability are different policies that are necessary for many businesses. Each coverage plays a separate role in the claims process. Check out the contrasts below:

- General liability: Pays for bodily injury, property damage, or slander claims arising from the business's operation. These occurrences may not have been preventable. General liability policies include coverage for premises liability, such as slips and falls.

- Premises Liability: Pays for negligence on the property owner's part. These claims are usually preventable and often just overlooked.

In essence, this means general liability is broader policy that includes premises liability coverage. With a premises liability policy, you could be missing out on other critical insurance.

What Does Premises Liability Insurance Cost in Tennessee?

In Tennessee, $6,317,565,000 in commercial insurance claims were paid in one year alone. To ensure that no loss gets taken from your bottom line, you'll want to know how your insurance costs are calculated. Take a look at what carriers use to determine your premises liability premiums:

- Location

- Square footage

- Property updates

- Age of building

- Prior claims

- Replacement cost of the property

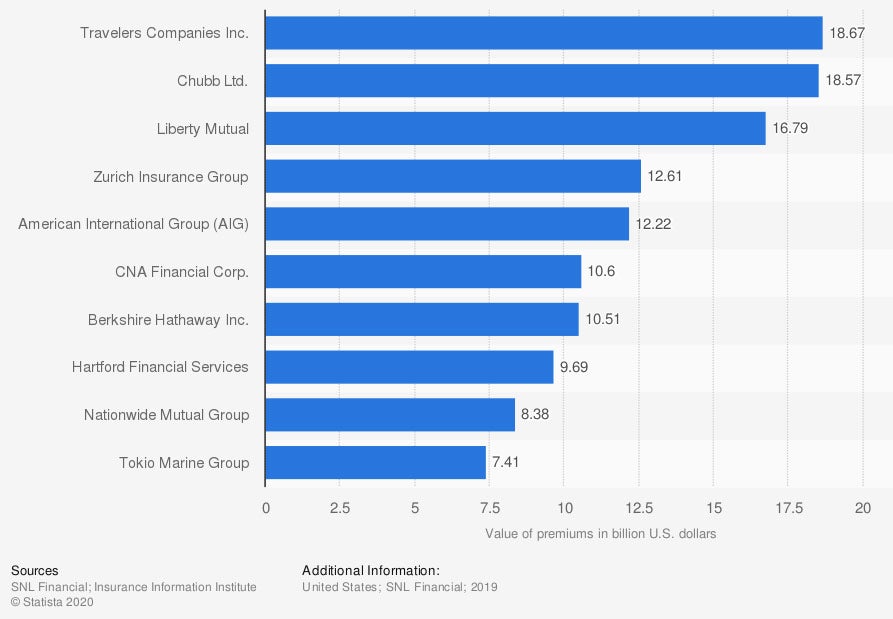

Leading writers of commercial lines insurance in the US, by direct premiums

Where your commercial insurance is through will determine the types and amounts of coverage you have. It is very telling which companies your peers choose.

How to Connect with a Tennessee Independent Insurance Agent for Free

When it comes to your business, premises liability coverage is usually necessary. Where you obtain protection from is another story and can be a bit confusing. Fortunately, a licensed professional can help review and find coverage for free.

A Tennessee independent insurance agent does the shopping for you at zero cost to your business. They'll compare policies and premiums through highly rated markets for best results. Connect with a local expert on trustedchoice.com to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/1215470/property-investment-volumes-usa-by-property-type/

https://www.statista.com/statistics/186457/us-commercial-lines-insurance-leading-writers-by-direct-premiums-written/

http://www.city-data.com/city/Tennessee.html